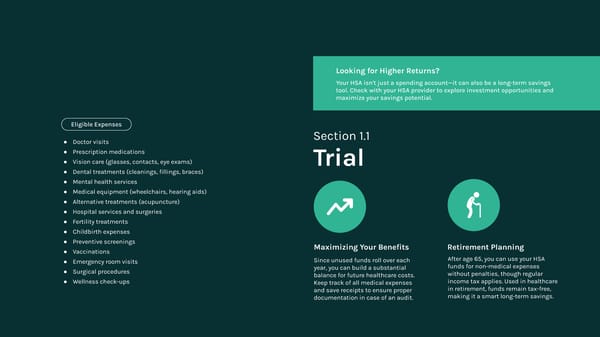

Trial Section 1.1 Eligible Expenses ● Doctor visits ● Prescription medications ● Vision care (glasses, contacts, eye exams) ● Dental treatments (cleanings, fillings, braces) ● Mental health services ● Medical equipment (wheelchairs, hearing aids) ● Alternative treatments (acupuncture) ● Hospital services and surgeries ● Fertility treatments ● Childbirth expenses ● Preventive screenings ● Vaccinations ● Emergency room visits ● Surgical procedures ● Wellness check-ups Your HSA isn't just a spending account—it can also be a long-term savings tool. Check with your HSA provider to explore investment opportunities and maximize your savings potential. Looking for Higher Returns? After age 65, you can use your HSA funds for non-medical expenses without penalties, though regular income tax applies. Used in healthcare in retirement, funds remain tax-free, making it a smart long-term savings. Since unused funds roll over each year, you can build a substantial balance for future healthcare costs. Keep track of all medical expenses and save receipts to ensure proper documentation in case of an audit. Maximizing Your Benefits Retirement Planning

Your Health Savings Page 7 Page 9

Your Health Savings Page 7 Page 9