Life Insurance Overview

This document provides an overview of life insurance options, highlighting different coverage types and additional features designed to secure financial protection and peace of mind.

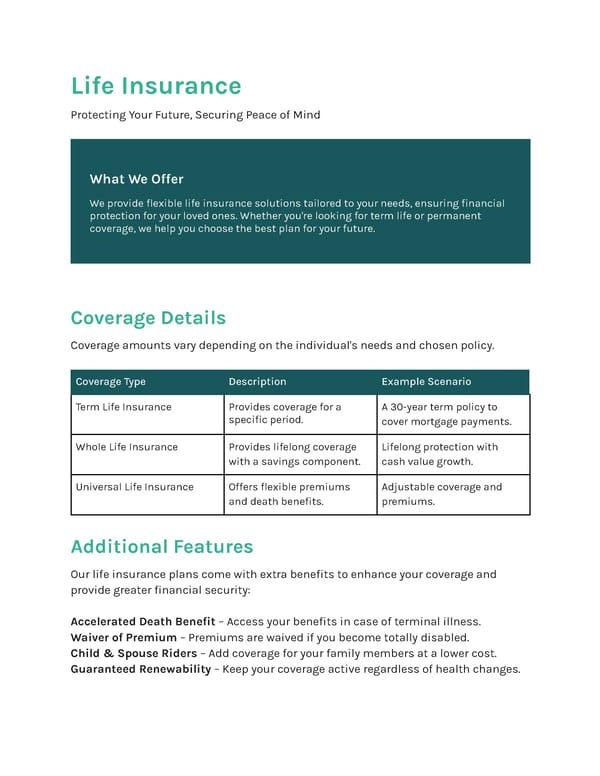

Life Insurance Protecting Your Future, Securing Peace of Mind Coverage Details Coverage amounts vary depending on the individual's needs and chosen policy. Coverage Type Description Example Scenario Term Life Insurance Provides coverage for a specific period. A 30-year term policy to cover mortgage payments. Whole Life Insurance Provides lifelong coverage with a savings component. Lifelong protection with cash value growth. Universal Life Insurance Offers flexible premiums and death benefits. Adjustable coverage and premiums. Additional Features Our life insurance plans come with extra benefits to enhance your coverage and provide greater financial security: Accelerated Death Benefit – Access your benefits in case of terminal illness. Waiver of Premium – Premiums are waived if you become totally disabled. Child & Spouse Riders – Add coverage for your family members at a lower cost. Guaranteed Renewability – Keep your coverage active regardless of health changes. What We Offer We provide flexible life insurance solutions tailored to your needs, ensuring financial protection for your loved ones. Whether you're looking for term life or permanent coverage, we help you choose the best plan for your future.

Life Insurance Overview Page 2

Life Insurance Overview Page 2