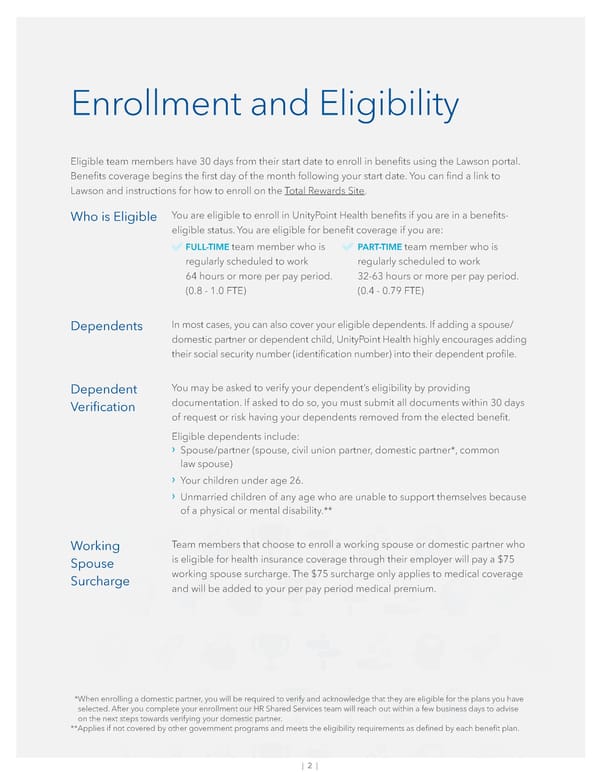

| 2 | * When enrolling a domestic partner, you will be required to verify and acknowledge that they are eligible for the plans you have selected. After you complete your enrollment our HR Shared Services team will reach out within a few business days to advise on the next steps towards verifying your domestic partner. **Applies if not covered by other government programs and meets the eligibility requirements as defined by each benefit plan. Enrollment and Eligibility Eligible team members have 30 days from their start date to enroll in benefits using the Lawson portal. Benefits coverage begins the first day of the month following your start date. You can find a link to Lawson and instructions for how to enroll on the Total Rewards Site. Who is Eligible You are eligible to enroll in UnityPoint Health benefits if you are in a benefits- eligible status. You are eligible for benefit coverage if you are: FULL-TIME team member who is regularly scheduled to work 64 hours or more per pay period. (0.8 - 1.0 FTE) PART-TIME team member who is regularly scheduled to work 32-63 hours or more per pay period. (0.4 - 0.79 FTE) Dependents In most cases, you can also cover your eligible dependents. If adding a spouse/ domestic partner or dependent child, UnityPoint Health highly encourages adding their social security number (identification number) into their dependent profile. Dependent Verification You may be asked to verify your dependent’s eligibility by providing documentation. If asked to do so, you must submit all documents within 30 days of request or risk having your dependents removed from the elected benefit. Eligible dependents include: › Spouse/partner (spouse, civil union partner, domestic partner*, common law spouse) › Your children under age 26. › Unmarried children of any age who are unable to support themselves because of a physical or mental disability.** Working Spouse Surcharge Team members that choose to enroll a working spouse or domestic partner who is eligible for health insurance coverage through their employer will pay a $75 working spouse surcharge. The $75 surcharge only applies to medical coverage and will be added to your per pay period medical premium.

Team Members Guide Page 3 Page 5

Team Members Guide Page 3 Page 5