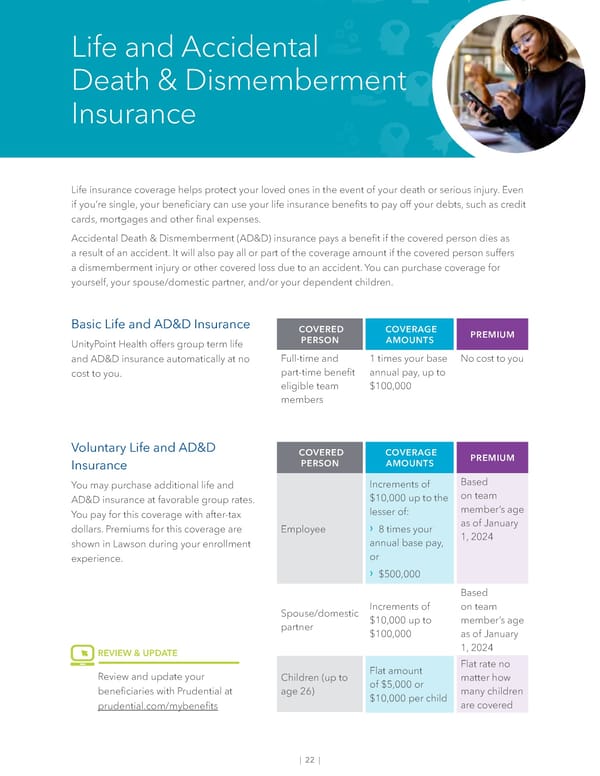

| 22 | Life and Accidental Death & Dismemberment Insurance Life insurance coverage helps protect your loved ones in the event of your death or serious injury. Even if you’re single, your beneficiary can use your life insurance benefits to pay off your debts, such as credit cards, mortgages and other final expenses. Accidental Death & Dismemberment (AD&D) insurance pays a benefit if the covered person dies as a result of an accident. It will also pay all or part of the coverage amount if the covered person suffers a dismemberment injury or other covered loss due to an accident. You can purchase coverage for yourself, your spouse/domestic partner, and/or your dependent children. Basic Life and AD&D Insurance UnityPoint Health offers group term life and AD&D insurance automatically at no cost to you. Voluntary Life and AD&D Insurance You may purchase additional life and AD&D insurance at favorable group rates. You pay for this coverage with after-tax dollars. Premiums for this coverage are shown in Lawson during your enrollment experience. COVERED PERSON COVERAGE AMOUNTS PREMIUM Full-time and part-time benefit eligible team members 1 times your base annual pay, up to $100,000 No cost to you COVERED PERSON COVERAGE AMOUNTS PREMIUM Employee Increments of $10,000 up to the lesser of: › 8 times your annual base pay, or › $500,000 Based on team member’s age as of January 1, 2024 Spouse/domestic partner Increments of $10,000 up to $100,000 Based on team member’s age as of January 1, 2024 Children (up to age 26) Flat amount of $5,000 or $10,000 per child Flat rate no matter how many children are covered REVIEW & UPDATE Review and update your beneficiaries with Prudential at prudential.com/mybenefits

Team Members Guide Page 23 Page 25

Team Members Guide Page 23 Page 25